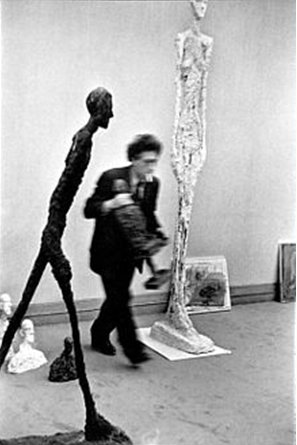

The art world has but a few watershed moments these days. However, the recent purchase of Giacometti’s “Homme qui Marche” for $104M USD is one of them. This is a BIG deal to a great many people for a great many reasons. Obviously, the sale means a great deal both to the buyer and the seller of this masterpiece. However, its significance to the art world as a whole and the to the broader world cannot be underestimated or easily quantified.

The fact that a bronze sculpture, one of 10 in the world, could command the type of pricing generally reserved for a one-of-a-kind painting is nothing short of ground-breaking.

The sale of “Homme qui Marche” represents a diametric shift in the perceptions of editioned and/or serialized sculptures. Never again can multiples be derided as being of less value than a signature work from a painter. Throughout the 20th century, the issue of rarity and speculation has become a hallmark of our art-buying culture. Whether or not we, as collectors, ever have chosen to “invest” in artwork, the idea of rarity is a prized concept for the art-buying public. The appeal of having the “original” of a particular work is singular. No one else has YOUR work in the world. However, the “original” in sculpture is often misunderstood as the general public is often unaware of the process involved in the production of a bronze. The “original” in sculpture is often destroyed in order to produce the end result, the bronze edition. In an age that permits artists to produce nearly identical serialized work in quantities and still maintain high quality controls allows self-marketability and broad distribution capabilities. A byproduct of this production in the 20th century however, has been that the public often seeks rarity within specific composition’s editions. Many clients will make specific requests of “Artist Proofs” (which formerly carried a negative connotation, but is now thought of as a desirable, rare edition), or the lowest numbers in any given edition. At this point, there is no clear-cut correlation between high prices for Artist Proofs or low numbers in a given edition versus standard edition works. While this may change as we move forward, this is more often than not, a misnomer presently.

Contemporary sculptors such as M.L. Snowden (American, b. 1952) had issued editions of 100 numbered bronzes at the outset of her career and experienced a great deal of commercial success. However, with her recent editions of 25 selling out as quickly as she can produce them, she has opted to stick with rarer editions to promote fiscal growth in her oeuvre. Her popular composition “Solaris” sold out all 25 examples in a matter of months propelling her pricing from under $16,500 to over $85,000, based on rarity and consistent demand, all during a slow economic cycle.

Jackson Pollack’s “No. 5, 1948” which sold for $140M USD, Willem DeKooning’s “Woman III” which sold for $137.5M USD and “Portrait of Adele Bloch-Bauer” by Austrian Master Gustav Klimt which sold for $135M USD, have set the high-water mark for art sold in today’s world. Each were sold in private sales arranged by dealers, and each, as you can see, are paintings. The highest priced work ever bought or sold at auction is “Garçon à la Pipe“ after having sold for $104M USD in 2004. It too, obviously, is a painting. Never before have editioned sculptures been mentioned in the same breath as having broken the $100M USD plateau, much less becoming the highest priced work ever sold at auction.

In the 1980’s a Japanese investor offered $100M USD for a lifetime casting of French Master Auguste Rodin’s “The Thinker” (Large 181cm)… despite this translating to approximately $198M USD in today’s money…. no one who owned one would sell. Had this work sold, it would have changed the dynamic at work and perceptions toward editioned sculpture as there were approximately 10 examples which would have fit the buyer’s criteria. However, it did not, and nearly 25 years later we only now realize an edition as being on par with one-of-a-kind works.

The inauspicious unveiling of French Master Edgar Degas’ wax modele of “Petite Danseuse de Quatorze ans” in 1881, prompted Degas to never issue bronzes of any of his works. Posthumous editions of his work were begun shortly after his death in 1917 by the Hebrard Foundry in Paris in collaboration with Degas’ estate. The Hebrard foundry cast no fewer than 29 “Petite Danseuse” bronzes between 1922-1937. Despite the fact that they were posthumous editions and that the edition was considered large for the age, the work has experienced no diminution in interest or real or perceived value. One example of “Petite Danseuse” sold for $16.9M USD on February 3, 2009 at Sotheby’s London [Sotheby’s London, 3 Feb 2009, Lot #8]. In an effort to institutionalize exclusivity, the French government adapted a law in 1978 mandates that bronzes “cannot in any case exceed twelve examples”. While exclusive to France, many artists internationally have adapted this as doctrine in subsequent years in an effort to create demand based on rarity and exclusivity.

The Flip Side:

In contrast to positive impact a sale of this nature brings to the art world, larger questions must also be asked. A respected friend and fellow historian recently questioned me thusly, “In the context of all that is required to save lives around the world in a disaster zone, the only diametric shift in my perception the sale triggers is one of extreme distaste at the implicit obscenity of such a purchase. Had this current age any semblance of grace, the proceeds from the sale…aka revenue to Deutsche Bank would be redirected to some program to support children in dire need or at least be put to use to combat human trafficking which is erasing future human resource and preventing the advent of a future Giacometti…that in itself is a crime don’t you think?”

Notwithstanding the audacity of the purchase price itself, yes… the world may be better served as a whole if those with disposable income at this level donated it to help those less fortunate. We live in, and always have lived in, a world which is inherently unfair towards the haves and the have-nots. In a time which was rife with disease and starvation, The Medici’s were commissioning some of the world’s greatest masterpieces, and at great personal expense. The Holy See continued to amass incredible collections of art and treasure, even while wars were waged and children suffered. Mere months after 9/11, the Gaffe Collection sold at Christie’s New York for a total of $108M, only a few blocks from where workers were toiling at recovery efforts at the World Trade Center… Other records were also set in the 2002 auctions, including by Giacometti whose “Grande tete de Diego,” sold for $13,759,500 [Sotheby’s NYC, May 8, 2002] and Juan Gris set a record for the artist at the same sale, when his “Le Pot de Geranium” sold for $8,479,500. Records for Constantin Brancusi and Magritte were also set within 8 months of Sept 11, generally to American buyers.

While not a justification, it becomes merely an indication that those with money always have and always will indulge themselves with it.

Further, this does not preclude those very same people from also being generous donors. Many of the world’s wealthiest people donate a significant portions of their time, resources and money to noble causes, all while still maintaining the lifestyle they and their families are accustomed to.

The Robb Report recently featured an article which noted that the average salary of a person purchasing the new Rolls Royce was $10M USD per year. The buyers generally paid cash and the vehicle was approximately $450k USD. Many felt this excessive at the time and scoffed at the audacity of someone to pay this amount for a car given the present economic climate. Their point though, was that the Rolls Royce buyer is spending an infinitesimal amount of his yearly salary for the vehicle, whereas someone making $80k per year and buying a $50k Lexus spends the vast majority on their yearly salary on a vehicle. Further, in a debt-ridden culture as we have here in the United States, the Lexus is not even owned by the driver, but rather by a bank.

I cannot sit here and justify the purchase price of this work. I am not in the position to identify with the mind-set of the buyer, nor do I know their contributions to the larger world. Is it a record? Yes. Is it astounding? Absolutely. Might it be an anomaly? Of course.

But either way… It is news.