Art as investment

WHY INVEST IN ART?

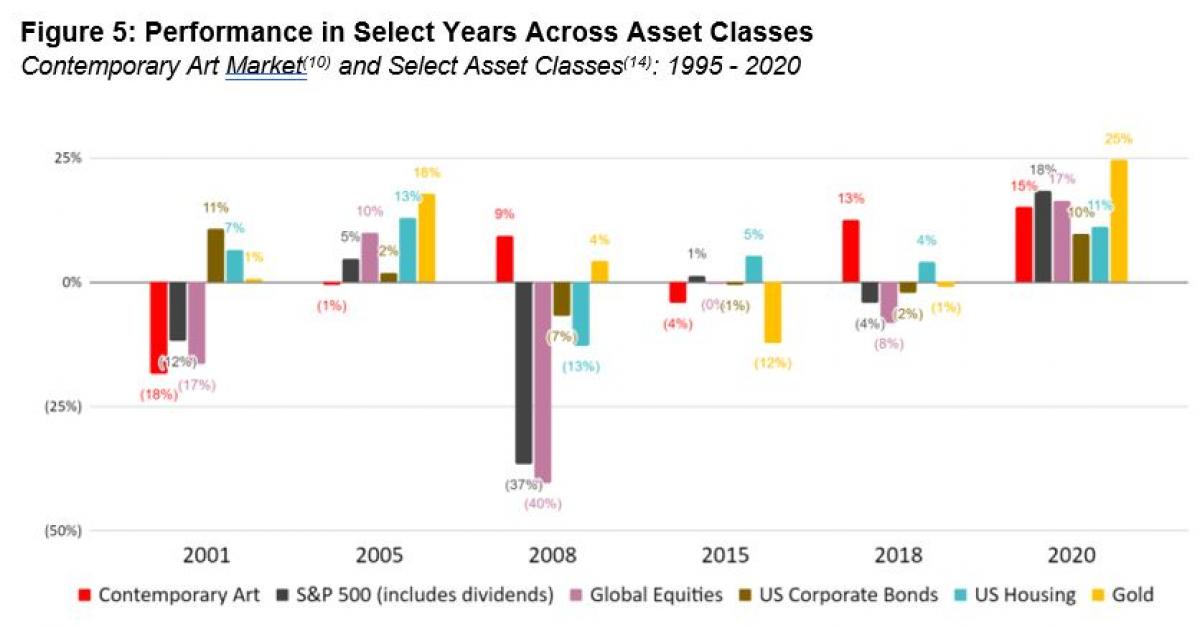

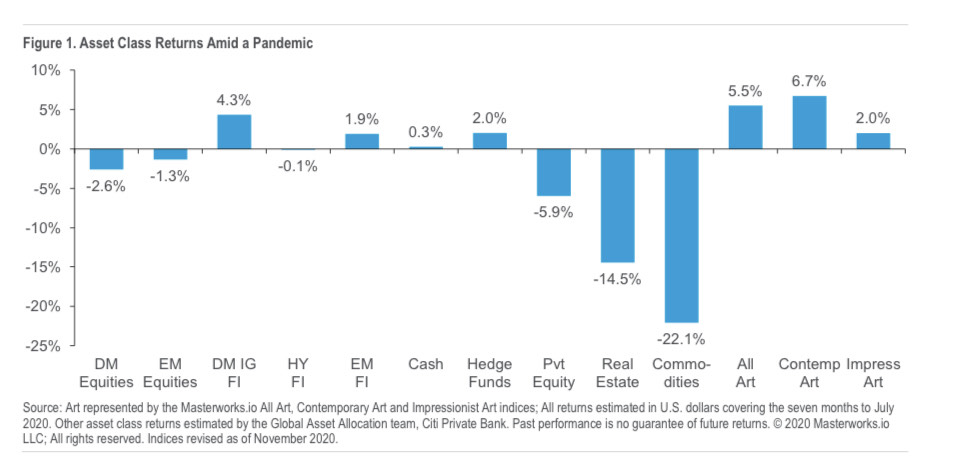

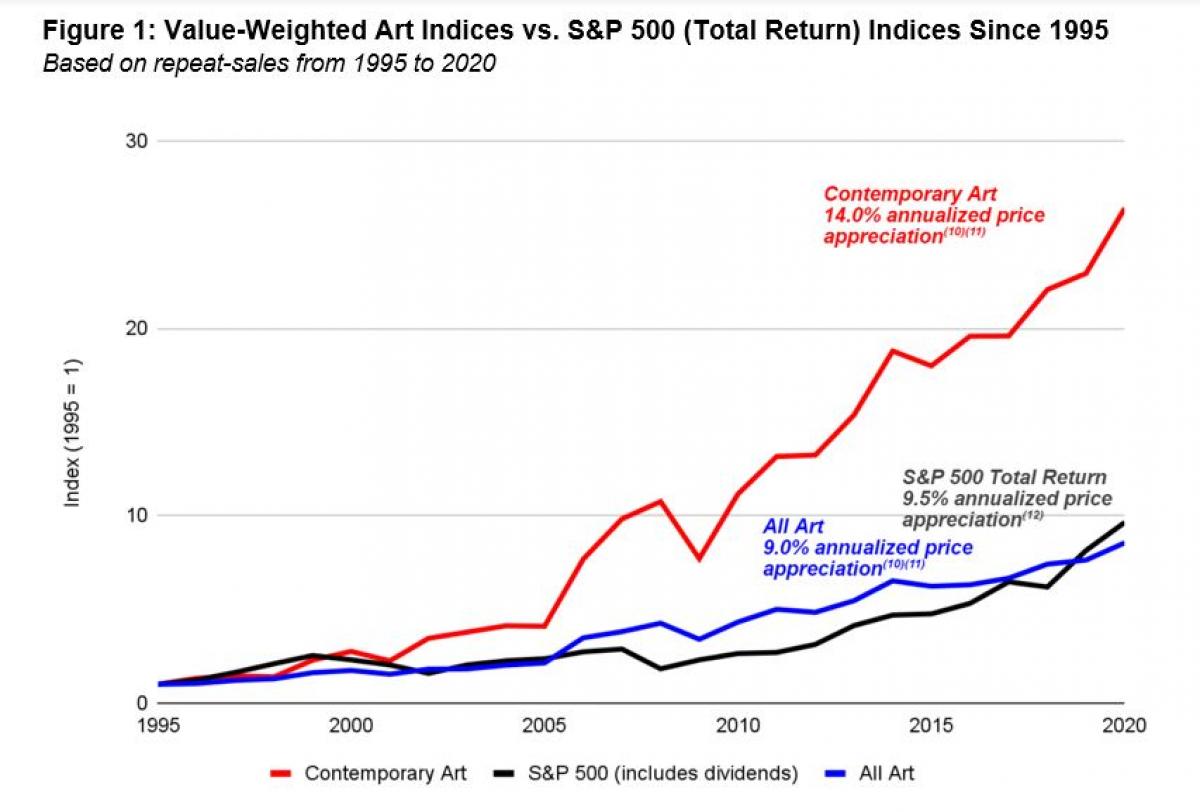

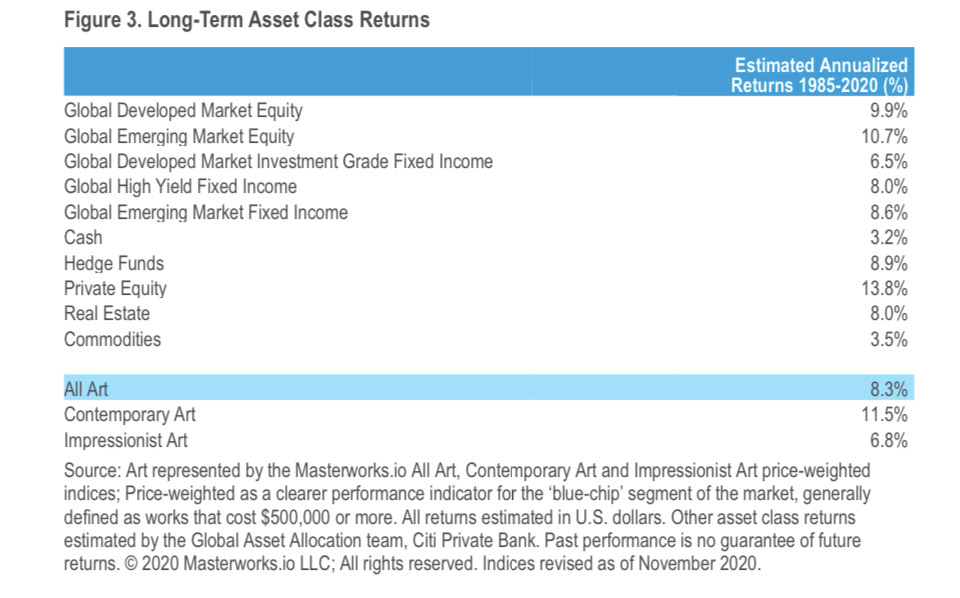

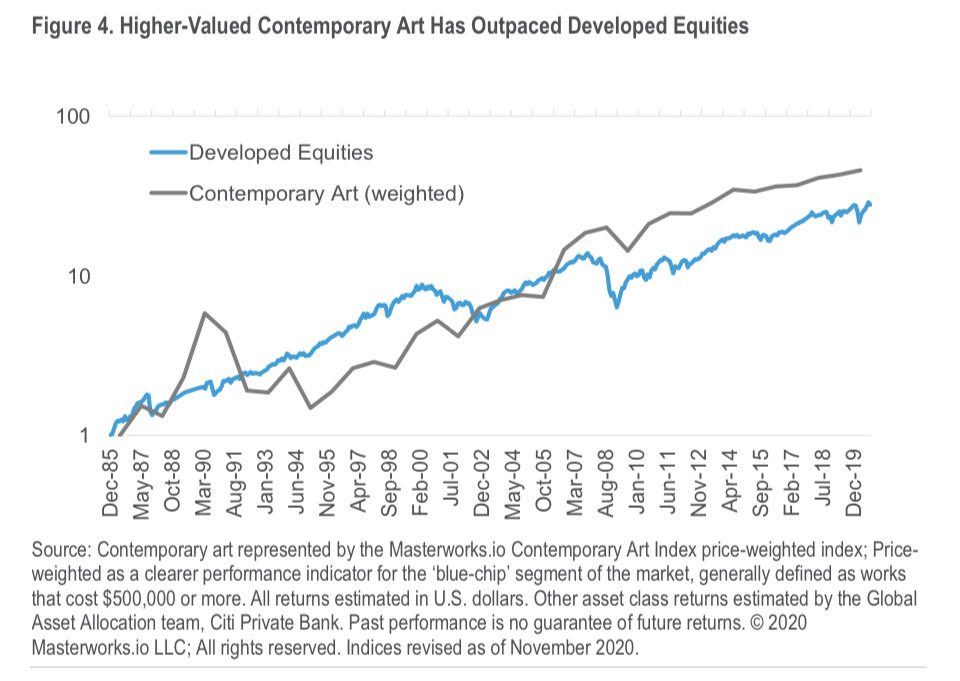

While art is not necessarily a traditional investment vehicle, there is no denying that art has been an integral part of the lifestyle and portfolios of investors for much of the last two centuries. Savvy investors hunt artwork as a hedge against economic uncertainty and as a way to diversify investment portfolios. Considered a “treasure asset”, art outperforms the S&P 100 and the FTSE 100 consistently and has a tangibility which many other investments cannot offer. In a report from Citi on the global art market in the first seven months of 2020, art outperformed 10 major asset classes including hedge funds and real estate, cementing itself as a powerful means of diversification.

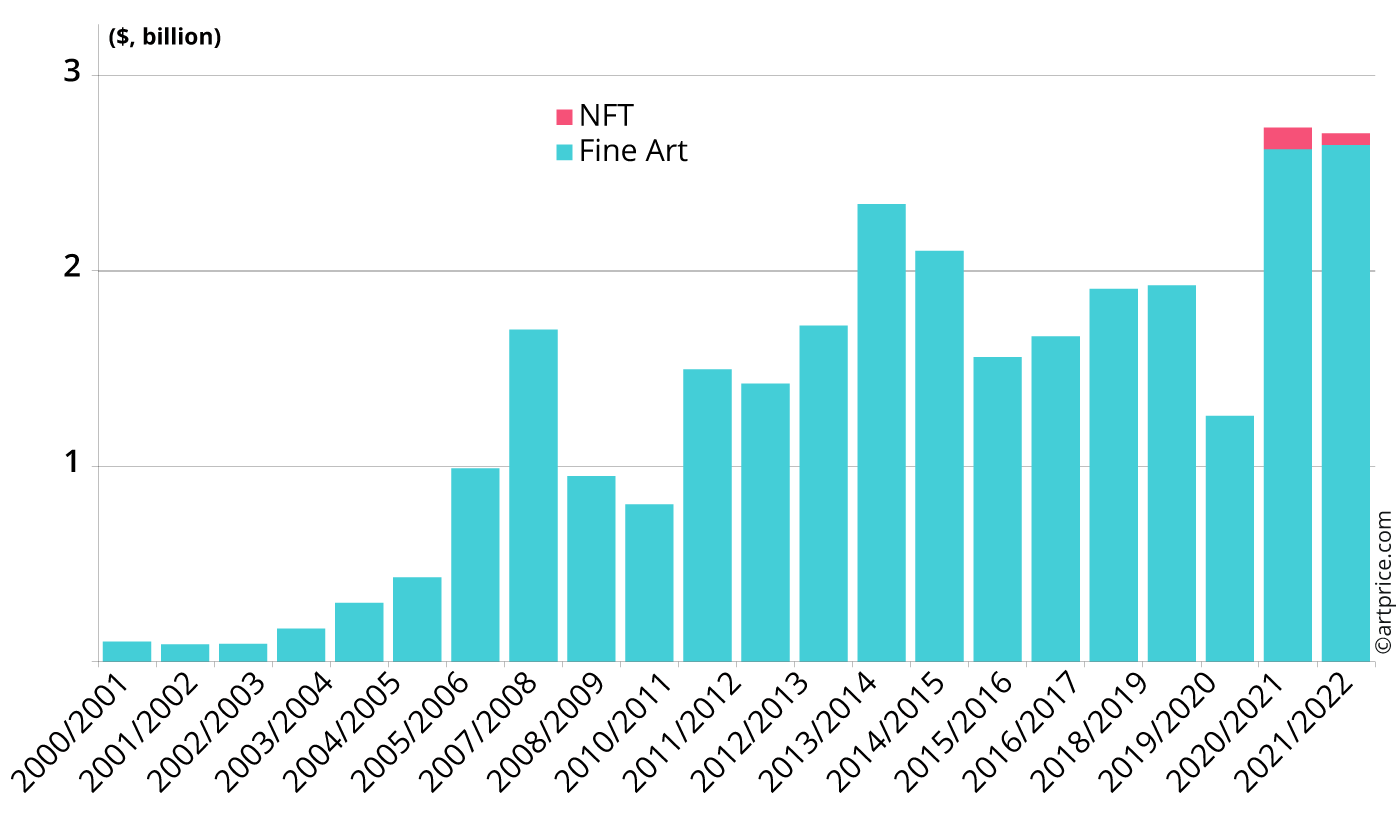

2022 has seen the highest inflation rates in 40 years with stocks and bonds declining, cryptocurrency “crashes” and the Euro and Pound reaching record lows against the US Dollar. Yet, the art market has consistently broken records in both the private sales and auction settings. Christie’s, Sotheby’s and Phillips reported increases in sales of 25% in 2022, and dwindling supply creates scarcity.

The resilience of contemporary art is due in part to the market’s ability to regulate supply and demand. In general, established artists avoid massive swings in value (both high and low) with prices remaining relatively stable even during tumultuous financial times. In 2021, the unsold rate of auctions was at its lowest level for several years at 31% versus the fluctuating 34%-39%. According to the Artprice Yearly Report “This indicates a clear balance between supply and demand and the establishment of a formidable sales dynamic, which benefits all market segments, from the most affordable works to the most prestigious.”

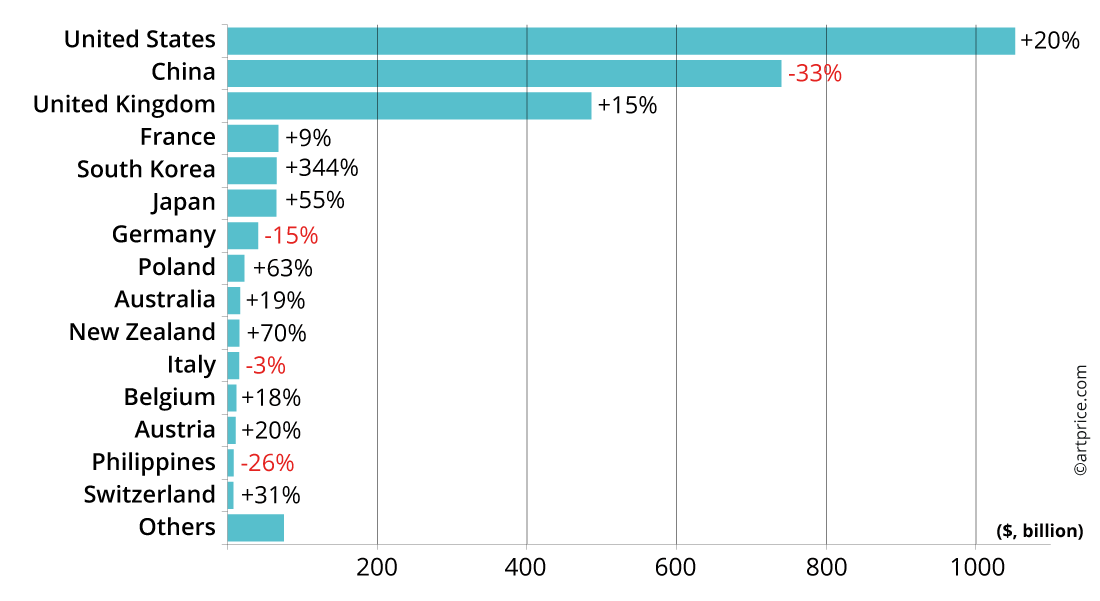

According to the yearly report published by Artprice, the art market had a very positive year in the review of 2021. “No less than $17 billion worth of artworks were exchanged around the world, representing a growth of +60% compared to the previous year when it should still be remembered, art sales suffered the full impact of the first waves of the Covid pandemic and a series of lockdowns.”

While seasoned collectors outbid one another in 2022, an increase of sales of lower priced artworks entered the market indicating that younger art collectors were emerging. The 2021 Annual Forbes list of the world's billionaires was up 660 members from 2020 and 86% of these billionaires had more wealth than they possessed the prior year. 2022 then also saw an influx of 2.5 million new millionaires, each with the capability to drastically alter the art world and global markets. The past two years has also seen ultra-high-net-worth individuals entering the art market buying at auction for the first time. Sotheby’s auction reported that 44% of all bidders were new buyers while Phillips auctions reported similar numbers. In auctions, the volume of transactions for works under $10,000 increased by 25% while the number of artworks being sold for over a million US dollars grew more than 44% compared to 2020.

The global Coronavirus pandemic during 2020 and 2021 shifted most art sales online with the shuttering of galleries, the closing of art exhibitions, and transition of auction houses to online sales. “As a gallery which has primarily worked online since the early 2000’s, we were already seeing a shift in client art-buying preferences pre-pandemic.” Says Reed V. Horth, President of Robin Rile Fine Art. “But, during 2020 we saw a seismic and permanent change in purchasing to an online model, paving the way for sales that are no longer limited to geographical location. This shift was not just limited to our established, long-time buyers, but also a newer, younger set of GenZ and millennial buyers”.

Between 2015 to 2019, Millennials' preference to buy online increased from 14% to 29% over the house of four years. According to Bain & Company, Millennials accounted for 35% of luxury goods consumption in 2019 with a forecast of 45% by 2025, much of which is driven by a younger generation of Asian buyers. Millennials outspent older collectors by over three times, demonstrating not only the generational spending power but also the importance of social media and online sales in an increasingly more global art market. 94% of auction houses surveyed expected online sales to increase over the next five years according to the 2021 Art Basel & UBS Report.

With all these varied dynamics at play, long-time dealers such as Robin Rile Fine Art, have continued to expand globally, with current projects in Hong Kong, Australia, Singapore, Spain, Canada, UK, Mexico and elsewhere, and more on the horizon. We continue to innovate, seek new genres and methods to streamline processes and bring 20th Century and Contemporary art to generations of international art collectors, investors and institutions.

ARTPRICE

For the 2021/2022 period, Contemporary art weighed 17.6% of the total art market, whereas the Ultra-Contemporary art market (artists born under 40) represented just 2.7% of the total art market. However, the growth of this sub-segment alone explains a good part of the transformation of the art market as a whole: Ultra-Contemporary art concentrates all the major market trends (Women artists, NFTs, Street art, African artists, etc.) and reveals the ultra-competitive dynamic between New York, London, and Hong Kong, as well as the emergence of new capitals in the international market such as Tokyo and Seoul.

Top 20 Contemporary Artists by Auction Turnover (July 1, 2021 – June 30, 2022)

| Artist | Turnover | Lots Sold | Best Result | |

|---|---|---|---|---|

| 1 | Artist Jean-Michel BASQUIAT (1960-1988) | Turnover $268,048,572 | Lots Sold 88 | Best Result $85,000,000 |

| 2 | Artist BANKSY (b. 1974) | Turnover $127,794,344 | Lots Sold 1062 | Best Result $25,426,401 |

| 3 | Artist Yoshitomo NARA (b. 1959) | Turnover $106,387,163 | Lots Sold 550 | Best Result $15,430,800 |

| 4 | Artist George CONDO (b. 1957) | Turnover $77,950,869 | Lots Sold 150 | Best Result $4,950,000 |

| 5 | Artist Cecily BROWN (b. 1969) | Turnover $54,286,602 | Lots Sold 40 | Best Result $6,583,500 |

| 6 | Artist Christopher WOOL (b. 1955) | Turnover $50,229,684 | Lots Sold 56 | Best Result $13,190,250 |

| 7 | Artist Jeff KOONS (b. 1955) | Turnover $48,760,903 | Lots Sold 285 | Best Result $15,201,000 |

| 8 | Artist Adrian GHENIE (b. 1977) | Turnover $47,105,717 | Lots Sold 26 | Best Result $10,326,314 |

| 9 | Artist Peter DOIG (b. 1959) | Turnover $44,641,199 | Lots Sold 55 | Best Result $39,862,500 |

| 10 | Artist ZENG Fanzhi (b. 1964) | Turnover $39,906,746 | Lots Sold 29 | Best Result $6,172,094 |

| 11 | Artist Damien HIRST (b. 1965) | Turnover $39,227,426 | Lots Sold 845 | Best Result $5,609,900 |

| 12 | Artist Matthew WONG (1984-2019) | Turnover $37,207,428 | Lots Sold 22 | Best Result $5,897,150 |

| 13 | Artist Shara HUGHES (b. 1981) | Turnover $32,929,644 | Lots Sold 53 | Best Result $2,940,000 |

| 14 | Artist Ayako ROKKAKU (b. 1982) | Turnover $29,674,355 | Lots Sold 202 | Best Result $1,310,853 |

| 15 | Artist BEEPLE (b. 1981) | Turnover $29,445,836 | Lots Sold 6 | Best Result $28,985,000 |

| 16 | Artist Mark GROTJAHN (b. 1968) | Turnover $26,366,783 | Lots Sold 20 | Best Result $7,500,000 |

| 17 | Artist KAWS (b. 1974) | Turnover $26,130,499 | Lots Sold 1262 | Best Result $1,542,500 |

| 18 | Artist Nicolas PARTY (b. 1980) | Turnover $25,311,495 | Lots Sold 61 | Best Result $3,270,000 |

| 19 | Artist Stanley WHITNEY (b. 1946) | Turnover $23,335,540 | Lots Sold 58 | Best Result $2,319,000 |

| 20 | Artist Hurvin ANDERSON (b. 1965) | Turnover $22,179,745 | Lots Sold 19 | Best Result $10,138,262 |

OUR TEAM OF EXPERTS

Our team of Art Advisors combine their experience in portfolio management, insight into art investment and detailed knowledge of the contemporary art world to deliver high quality advice and consistent returns for our clients. With support from our Directors, your dedicated Art Advisor will provide expert input and guidance at every step of your investment journey.