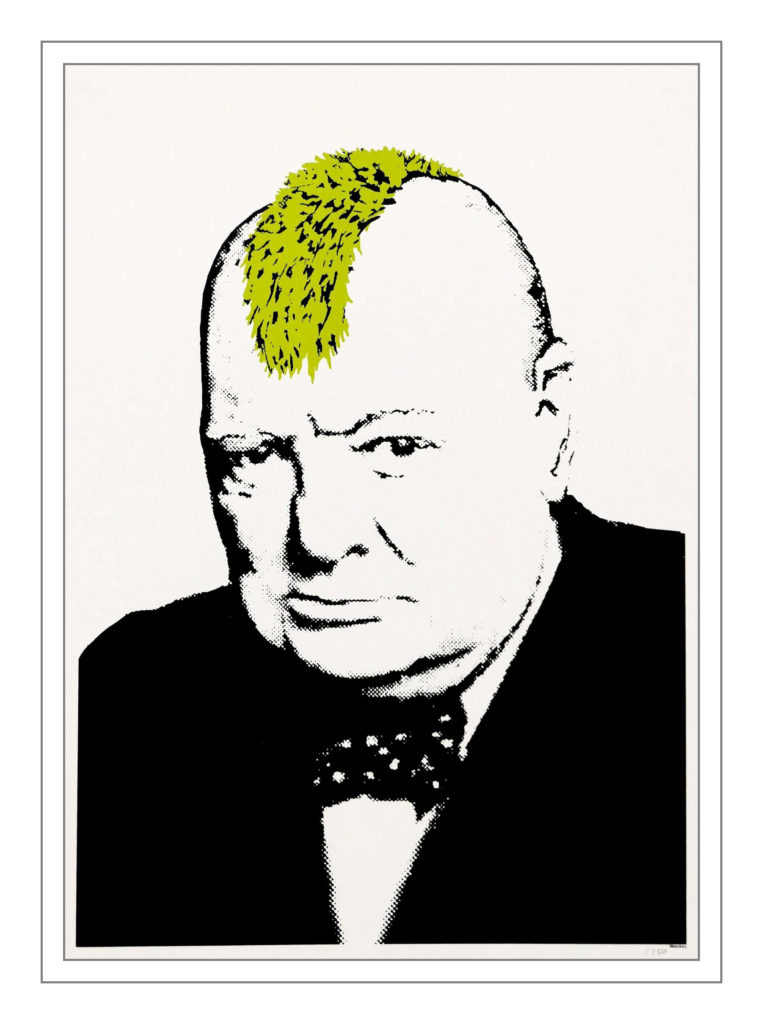

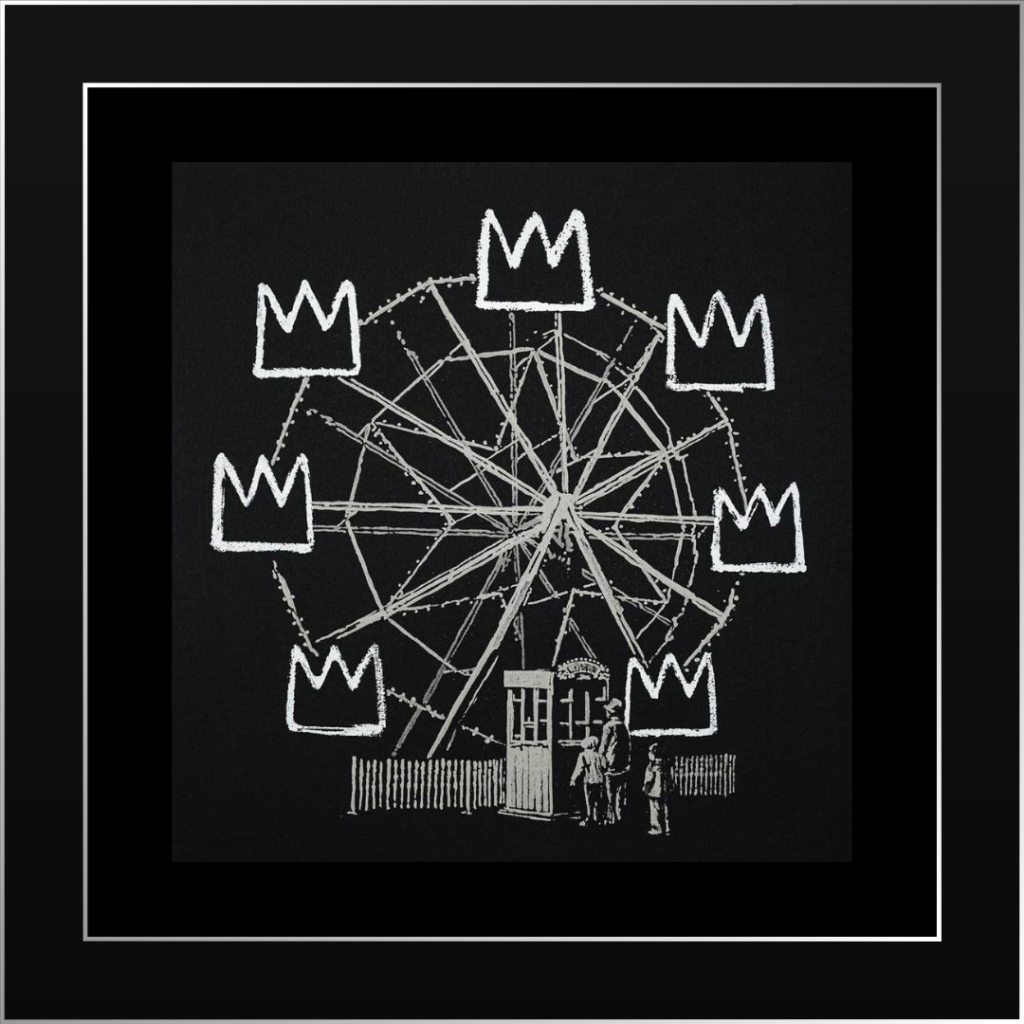

We are monitoring the investment potential of the most formidable maverick of Urban art: the legendary Banksy.

British Street Art Icon Banksy (b. 1974) has achieved unparalleled status unique to any other artist as he has skillfully managed to control the health and trajectory of his own art market through published signed and unsigned editioned prints of his stenciled imagery. Since arriving within the transfixing bubble of the secondary art market, Banksy’s art – and celebrity cult status – remains fierce and unapologetic, challenging viewers to critique socio-political issues that are too often unacknowledged.

BANKSY’S PERFORMANCE IN THE ART MARKET

The Banksy print market peaked throughout 2020 and 2021, demonstrating a tremendous surge in the annual growth rate (AGR) of total sales turnover (fees excluded) and total sales by volume, which measures the number of works sold annually. The AGR of total sales has steadily increased from 2018 to 2021, most drastically in 2020, increasing by 220% and an additional 110% in 2021. Likewise, total sales volume increased by 21% and 30% for the same consecutive years. These two areas of increase within Banksy’s last five-year trajectory are important indicators as they were the first substantial references to the artist’s secondary market growth and health.

BANKSY’S MARKET RESULTS 2022 – Q1 2023

Following the fanfare and substantial market figures, Banksy’s 2022 market has demonstrated a decrease in sales and revenue figures. The inverted U-curve in Banksy’s market suggests an interplay of complex economic market conditions, which can be credited to an oversaturated art market due to Banksy prints being bought and sold excessively throughout 2020-2021 or rising inflation rates in 2022 affecting overall art market conditions. Despite these economic analyses, Banksy’s market is unique. Banksy has resisted primary market gallery representation throughout his career, meaning that his entire market circulates on the secondary market via trades, auctions and private sales. This approach has the agency to counter cooling effects and further demonstrates the phenomenal demand for his work among collectors and art enthusiasts.

Banksy’s Q1 2023 auction turnover for signed and unsigned prints and multiples has currently achieved a total turnover in sales of $2.3 million (fees excluded). This figure is 60% short of the total turnover achieved in 2018. However, suppose Banksy’s market continues to increase sales volume for an approximate 14% quarterly rate. In that case, if more Banksy works continues circulating in the market and selling at profitable price points, this measure will drive the average selling price upwards, projecting the start of an S-Curve in his market, which is evidence of an upward market trajectory.

Banksy Return Rate

Data shows an average return rate on Banksy prints and editions from various series of 47%. Considering the increasing interest in art lending services and the desire to release capital from existing art collections, now is an appropriate time to reassess which artists are worth investing in. We will be watching closely to see if the sales volume and revenue in Banksy investment trends in 2023 will match or surpass that of previous years.

Final note – Banksy investment trends are currently at the low, low point, and anything bought now is a AAA investment. My opinion is that over the long term anything bought now is a winner.

For pricing and availability, please DM or email info@robinrile.com

Analysis from Bradley George, London. We are not investment advisors. We can merely report on trends as we see them.